Clark County assessor

PO BOX 551401. Marshall IL 62441.

Be Sure To Lower Your Property Tax By Filing A Primary Residential Tax Cap Claim Ksnv

In no event will the assessor be liable to anyone for damages arising from the use of the property data.

. CLARK COUNTY EXEMPTION RENEWALS. Clark County Assessor Lisa Richey. Suite 280 Athens GA 30601.

Physical Address 325 E Washington St. Ex-Aide Releases Melania Trumps Revealing 1-Word Text Message From Jan. These values are used to calculate and set levy rates for the various taxing districts cities schools etc in the county and to equitably assign tax responsibilities among taxpayers.

The Clark County Assessor may provide property information to the public as is without warranty of any kind expressed or implied. We serve the public with integrity in a helpful professional knowledgeable and timely manner. Access code is required.

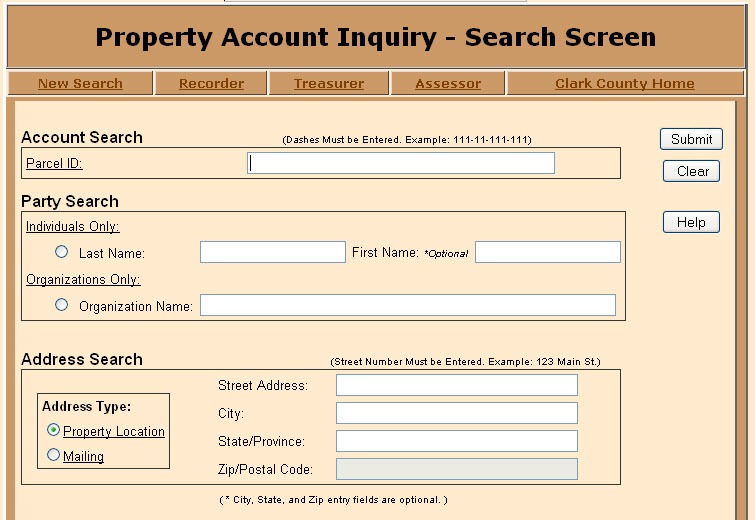

County Courthouse 501 Archer Ave. The Clark County Assessor will be offering assessment information online starting February 1 2021. Welcome to the Assessors Office.

I will notify the Assessor if the status of this property changes. We hope that you find this system helpful. Click here to search property records online.

Clarke County Assessor Courthouse 100 South Main Street Osceola IA 50213 Voice. If you have questions or comments please call our office at 870 246-4431. A Clark County assessor addresses the property tax cap situation.

4652 GISTechSupportclarkwagov 360 397. If you are applying for a new exemption or do not have the required information please contact our office at 702-455-3882. Clark County Assessors Office 300 Corporate Drive Suite 104 Jeffersonville IN 47130 Tel.

Enhanced Enterprise Zone Application. FOX5 - Clark County homeowners have a June 30 deadline to update their information with the assessors office in order to avoid paying a higher property tax rate. We could not find your account.

The ACC Tax Assessors Office appraises all property located in Athens-Clarke County at its fair market value to ensure taxpayers pay no more than their fair share of property taxes. The Clark County Assessor may provide property information to the public as is without warranty of any kind expressed or implied. Each year the Assessors Office identifies and determines the value of all taxable real and personal property in the county.

Clark County Auditor John S. The assessed values are subject to change before being finalized for ad valorem tax. Type your query in the box and click Go.

Courthouse Square 401 Clay St Arkadelphia Arkansas 71923. LAS VEGAS NV 89155-1401. Federer announced today that Senate Bill 57 was passed and is a response to COVID 19.

Add What is the difference between a property tax levy and a property tax levy rate. The Clark County Assessors Office makes every effort to produce and publish the most current and accurate information possible. Ad Look Here For Clark County Property Records - Results In Minutes.

The Clark County Assessors Office locates identifies and appraises all taxable property accurately uniformly and equitably in accordance with Indiana law. Our employees are empowered to improve themselves and the Assessors Office through. 15 hours agoNext Washoe County assessor.

No warranties expressed or implied are provided for the data herein its use or its interpretation. Need Property Records For Properties In Clark County. People still have until next year to apply for the 3 percent tax cap.

You can call us at 5643972391 or email at assessorclarkwagov to schedule. GIS Technical Support GISTechSupportclarkwagov 360 397-2002 ext. The bill allows a property owner to seek a reduction in the true value of their property which is caused due to a circumstance related to COVID 19.

2020-0401 Stay At Home Order. Additionally statutory exemptions may affect the taxable values. Then click the ID number for your match to see more information.

Clark County Property Tax Information. 21 hours agoLAS VEGAS Nev. RETURN THIS FORM BY MAIL OR EMAIL TO.

As far as endorsing a candidate to replace him as the next county assessor Clark said he supports both candidates who. CLARK COUNTY ASSESSOR. A C C E S S D E N I E D.

500 S GRAND CENTRAL PKWY. For tax year 2020 the complaint must be filed from August 3 2021 through. You assume responsibility for the selection of data to achieve your intended results and for the.

By renewing online you DO NOT need to mail in the attached postcard. Clark County Assessor Peter Van Nortwick is available to speak at neighborhood meetings and to business groups. 830 - 430 pm.

Enhanced Enterprise Zone Public Hearing UPDATE. Skip to Main Content. CARES Act Second quarter application due no later than September 15 2020 Clark County Order No.

Assessed values are subject to change by the assessor Board of Review or State Equalization processes.

Clark County Assessor And Recorder Public Services Government 3211 N Tenaya Way Las Vegas Nv Phone Number Yelp

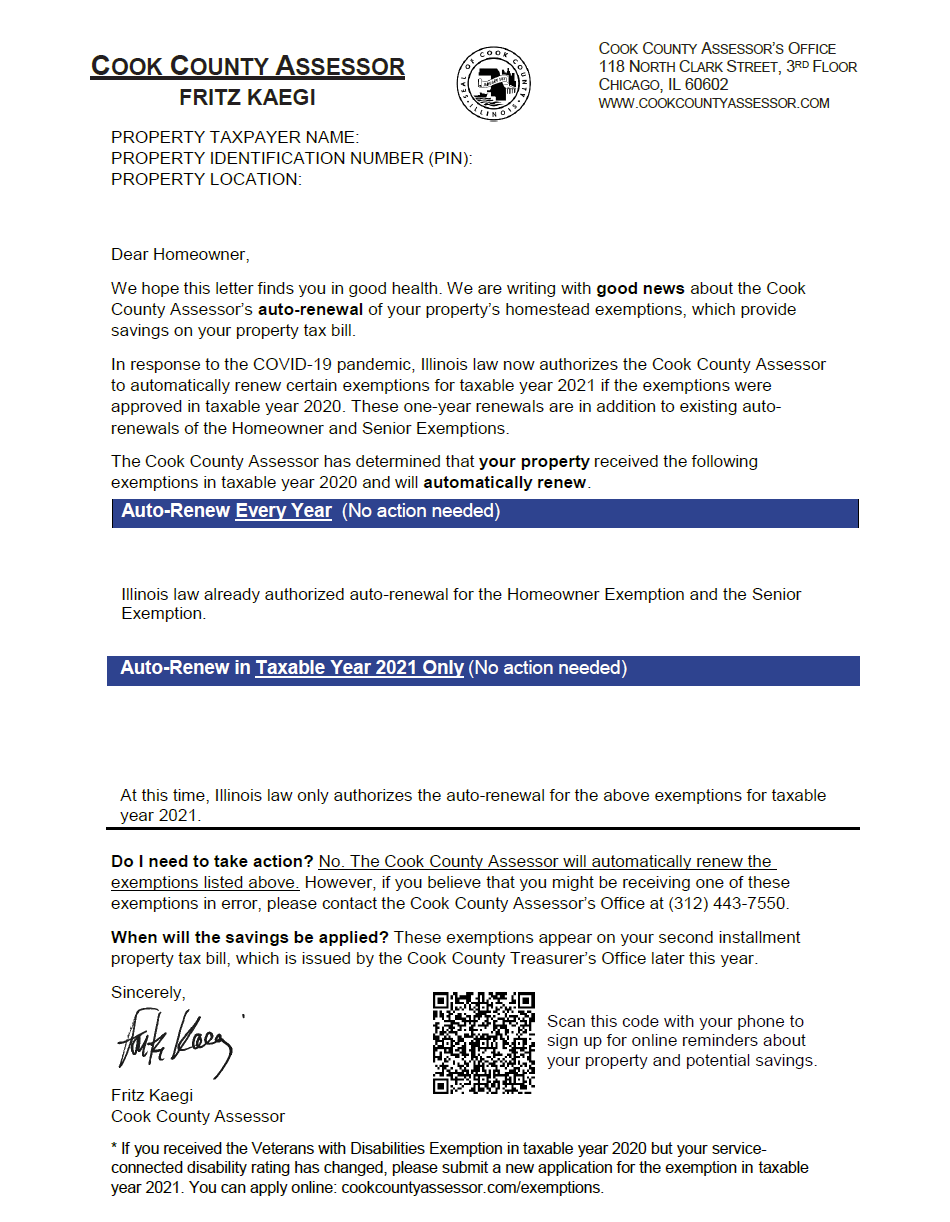

Mail From The Assessor S Office Cook County Assessor S Office

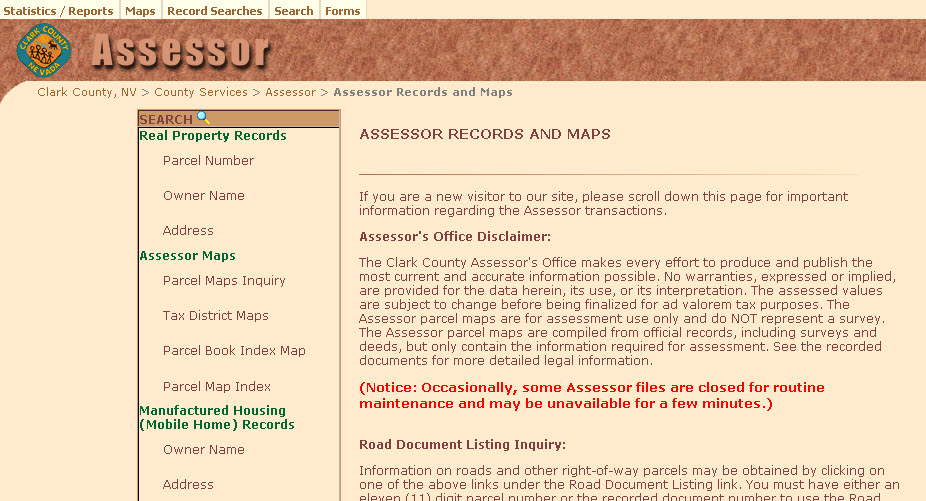

Clark County Nv

Clark County Assessor Briana Johnson Talks About Property Assessments In The Valley Youtube

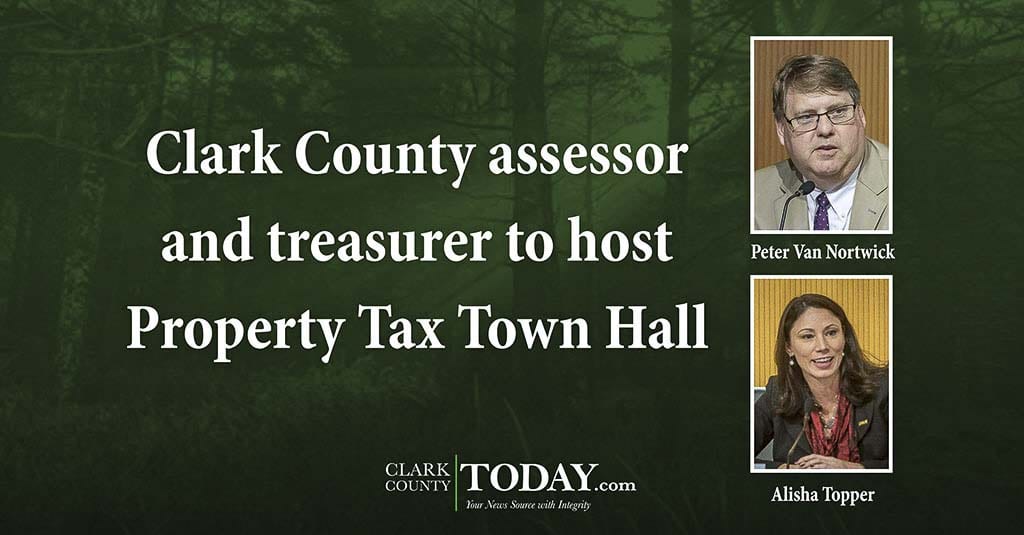

Clark County Assessor And Treasurer To Host Property Tax Town Hall Clarkcountytoday Com

Mesquitegroup Com Nevada Property Tax

Are You Paying The Right Amount For Property Taxes

Clark County Nv

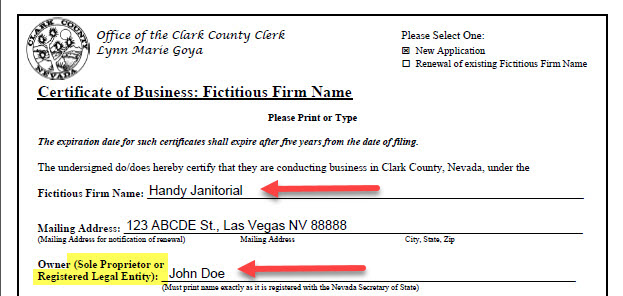

2

Clark County Nv

Clark County Recorder Assessor Northwest Branch On Tenaya Way Now Open

Clark County Gis

Clark County Assessor And Treasurer To Host Property Tax Town Hall Clarkcountytoday Com

How To Get To Clark County Assessor Recorder S Office In Las Vegas By Bus

Clark County Assessor 3211 N Tenaya Way Las Vegas Nevada Us Zaubee

Mesquitegroup Com Nevada Property Tax

2